“I invested my savings. Now, I have nothing.” These haunting words are being echoed by thousands of Nigerians who fell victim to CBEX, a platform once known as the next big thing in crypto trading. While reports cite over ₦1.3 trillion as the total value in user wallets when CBEX crashed, this figure reflects the inflated ‘book value’ shown to investors, not actual cash deposits. The platform had been displaying doubled amounts as part of its promise of high returns, meaning the real financial loss, though still massive, was likely far less.

What Was CBEX, and Why Was It So Popular?

CBEX positioned itself as a cutting-edge trading platform, boldly promising AI-powered crypto investments and massive returns that drew people in fast. Its slick interface and aggressive digital marketing made it look legitimate. The promise? 100% ROI in just 30 days, a tempting offer that lured in everyone from students and civil servants to retirees and small business owners.

But behind the flashy website and Telegram updates was a familiar scam model: a Ponzi scheme built on deception, tech jargon, and the hunger for quick wealth.

How the Scam Unfolded

CBEX began showing cracks on a Monday morning when users were suddenly unable to withdraw funds from their wallets. In a matter of hours, the platform shut down its withdrawal functions, deleted its Telegram channels, and wiped user data, leaving investors stranded and confused.

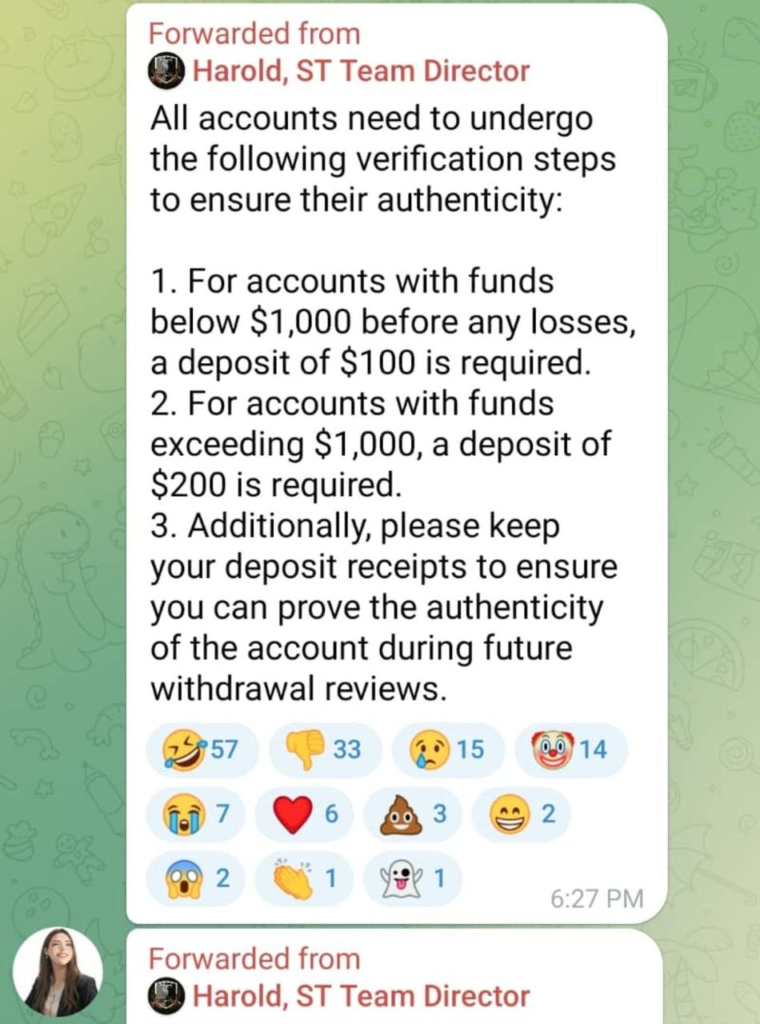

What followed was even more suspicious: a “verification” scheme asking users to pay $100–$200 more to unlock their accounts. This final move confirmed the fears of many; CBEX was never a legitimate platform.

Inside the Ponzi Playbook: How CBEX Operated

While CBEX sold itself as a transparent crypto-trading platform, here’s what was going on:

- Fake Trading Dashboards

Users were shown fabricated profits on AI-generated dashboards, giving the illusion that their funds were growing daily. - No Real Ownership of Funds

Deposits were redirected to TRX (Tron) wallets and converted to USDT and ETH, making funds untraceable and irretrievable. - Withdrawal Illusions

Despite high account balances, users couldn’t access their money. To maintain the illusion, fake withdrawal records were circulated. - Classic Ponzi Mechanism

Returns for early users were paid using funds from new investors. Once growth slowed, the system crashed — as all Ponzi schemes eventually do.

Red Flags Everyone Missed

Despite some obvious warning signs, CBEX thrived. Why?

- No Regulatory License: The platform operated without any registration or approval from Nigeria’s SEC.

- Website Mimicry: It copied the UI of reputable exchanges like ByBit and Binance to appear credible.

- Too-Good-to-Be-True Offers: 100% ROI in 30 days is unrealistic in any legitimate market.

- Aggressive Referral Marketing: Users were incentivized to bring in others, a hallmark of pyramid-style scams.

The real tragedy lies in who was affected: low-income earners, stay-at-home mothers, students, and small business owners, all lured by the dream of financial freedom.

Aftermath: From Financial Ruin to Public Outrage

When the platform collapsed:

- CBEX’s physical office in Ibadan was reportedly looted by angry investors.

- Victims have spoken out, sharing stories of lost life savings, broken families, and mounting debts.

- The Securities and Exchange Commission (SEC) issued yet another warning about the dangers of unregulated trading platforms.

Unfortunately, for most victims, recovery is unlikely. Digital Ponzi schemes are notoriously difficult to trace, and perpetrators often vanish without a trace.

Lessons for the Digital Finance Era

The CBEX scandal is more than a news story, it’s a wake-up call. As more Nigerians explore online investment, digital financial literacy and strong regulatory frameworks are essential. Here’s how to protect yourself:

Spot the Red Flags:

- Unusually high and fast ROI

- No clear licensing or company information

- Vague product or investment model

- Referral-based rewards

Check for Credibility:

- Is the platform licensed by the SEC or relevant authorities?

- Can you trace the company’s executives?

- Are funds stored in regulated wallets?

Demand Transparency:

Legitimate platforms will always provide clear terms, risk disclosures, and full access to your funds.

Final Thoughts & What You Can Do

CBEX promised opportunity but delivered devastation. It is now a textbook case of how digital tools can be used to exploit public trust. As the fintech wave continues to grow in Nigeria and across Africa, so must awareness, education, and regulation.

If you’ve been affected by CBEX or similar scams, report the case to:

- The Securities and Exchange Commission (SEC) Nigeria

- EFCC (Economic and Financial Crimes Commission)

- Local digital fraud watchdogs

Stay informed. Ask questions. And remember: if it sounds too good to be true, it probably is.