In a bold and quietly revolutionary move, Nigerian fintech platform Piggyvest has introduced a new feature called Wellness Checks. At first glance, it may appear as just another product update. In truth, it is a digital safeguard for your money, and a clear signal that Africa’s fintech space is evolving into a more mature, user-protective ecosystem.

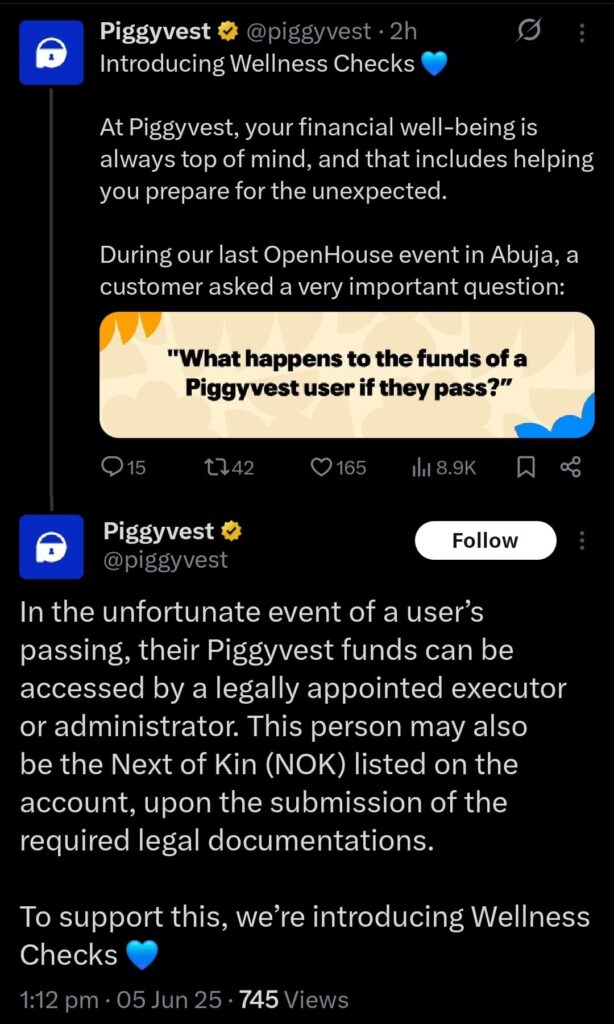

The announcement followed Piggyvest’s recent OpenHouse event in Abuja, where a customer posed a poignant question:

“What happens to the funds of a Piggyvest user if they pass?”

A Digital Will in Your Pocket

Piggyvest responded not with vague platitudes, but with structured clarity and action.

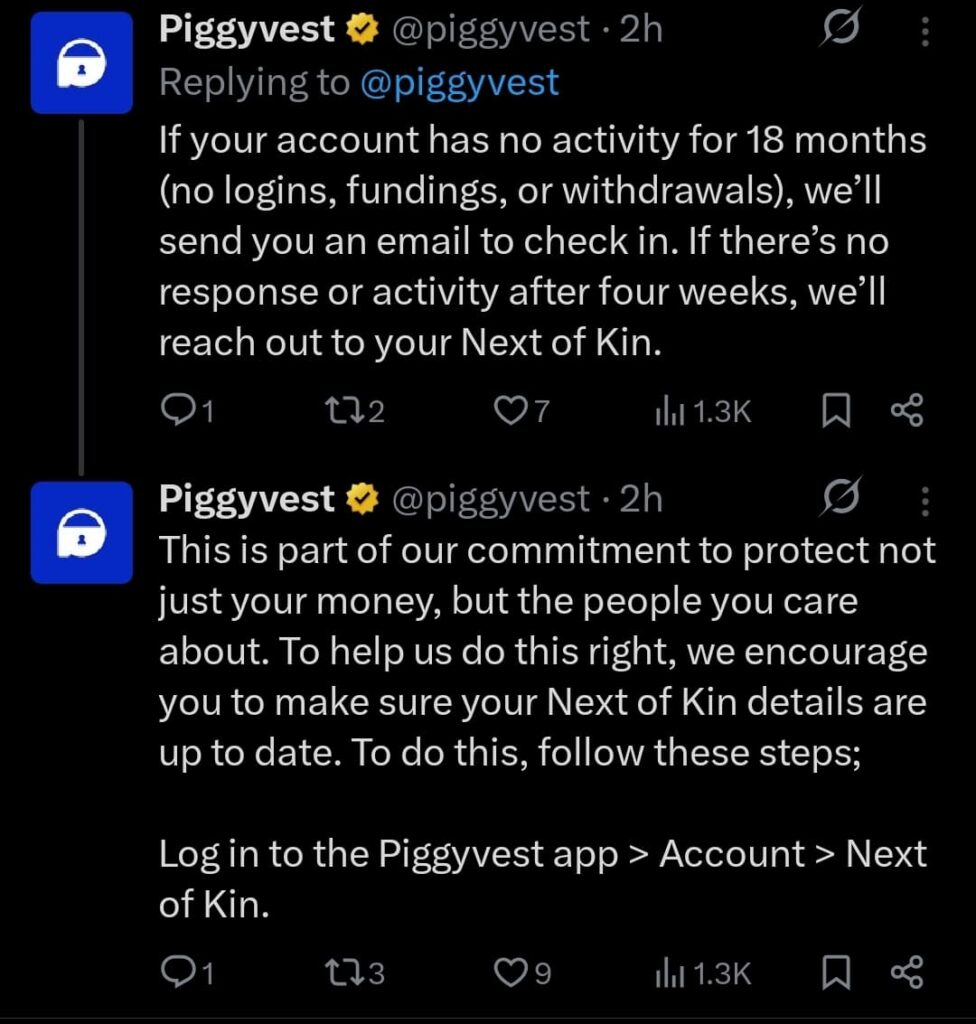

Wellness Checks introduce a defined protocol for user funds to be accessed responsibly in the event of death or long-term inactivity. If a user’s account remains dormant for 18 months, without any logins, withdrawals, or savings activity, Piggyvest will send a wellness check email. If there is still no response or activity after four weeks, the company will escalate the matter by contacting the person listed as Next of Kin.

In the unfortunate event of a user’s passing, Piggyvest permits fund access by a legally appointed executor or administrator. This individual may also be the registered Next of Kin, provided the necessary legal documentation is submitted.

This approach prioritises dignity, transparency, and foresight.

A Sector Coming of Age

This is not simply a thoughtful product enhancement. It represents a critical shift in the continent’s digital finance narrative. Africa’s fintech ecosystem is beginning to take on responsibilities that have long been associated with legacy financial institutions.

For decades, commercial banks have quietly profited from the deaths of account holders, absorbing vast sums from dormant accounts left untouched due to inaccessibility or lack of awareness. Families, often unaware of the funds or blocked by bureaucracy, have lost billions.

Piggyvest is changing that.

By institutionalising access rights, the platform introduces a culture of accountability. It ensures that digital savings do not disappear into institutional oblivion, but can be transferred with legal clarity to those left behind.

Designing for the Inevitable

African fintech is known for being fast, youthful, and disruptive. But true innovation must also encompass the full arc of life. Piggyvest is no longer just building tools for managing money while we live; it is now creating frameworks for what happens when we no longer can.

Wellness Checks are not about death. They are about continuity, security, and the affirmation that even in silence, your money speaks for you.

This feature does more than fill a gap. It rewrites the unwritten chapter of digital finance: the one that begins when life ends.

A Wake-Up Call for Other Platforms?

In a region where digital assets often die with the user, Piggyvest’s approach may force others to catch up. What happens to your crypto? Your online savings? Your investment apps? The silence around digital legacies is loud.

By institutionalising something as intimate and essential as preparing for death, Piggyvest is not only innovating but leading a cultural shift.