In a crowded fintech market, LiteFi is doing something refreshingly simple. It is helping salaried workers and overlooked small businesses access credit that matches their reality, and giving retail investors a clear way to put money to work through curated money market and commercial paper products. The goal is straightforward. Build trust, expand access, and grow wealth responsibly.

The Problem LiteFi Wants to Solve

Millions of Nigerians still sit outside the formal data trails that banks rely on. Salaried workers juggle rising costs, while small businesses and informal traders lack clean bank histories or collateral that a traditional lender will accept. The result is a gap that pushes people toward predatory lenders and risky schemes.

LiteFi’s co-founder Kayode Alao has spent over a decade in credit and fintech. His diagnosis is clear: many people are fundable, but the system cannot see them. LiteFi is building an alternative lens that blends financial and non-financial data, location, tenure in business, verifiable identity, and on-the-ground activity into a practical credit score.

“We look beyond the usual bank statements. We profile people responsibly with both financial and non-financial data, then structure financing that fits the business reality.”

What LiteFi Offers Today

Loans That Match Circumstances

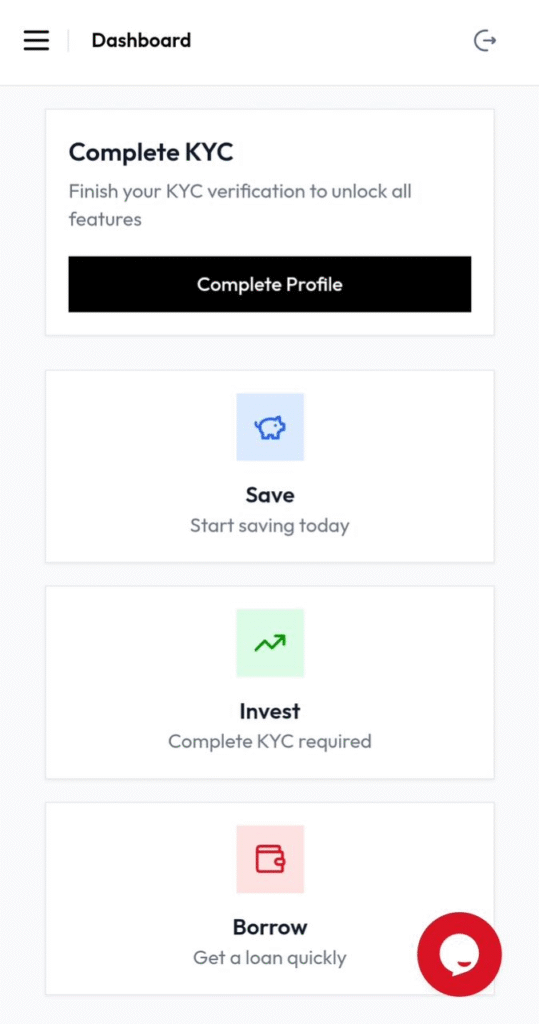

LiteFi began with auto-backed loans and has expanded into cash loans for salaried workers, SME lending, and dealer financing. The process runs through a lightweight web app designed for mobile users, with simple onboarding and fast approvals. For SMEs without structured financial records, LiteFi performs field verification to keep access inclusive but responsible.

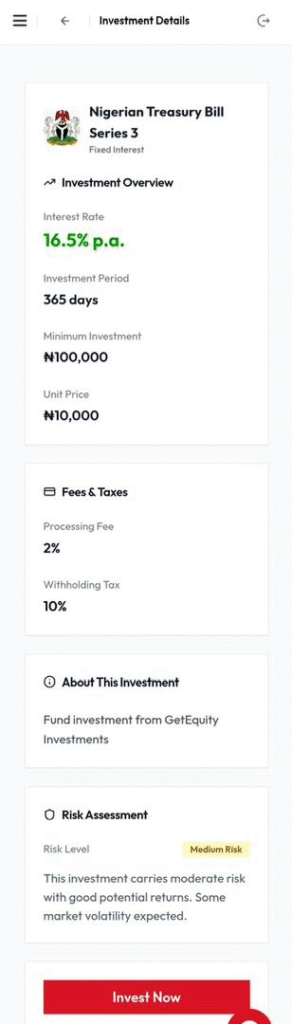

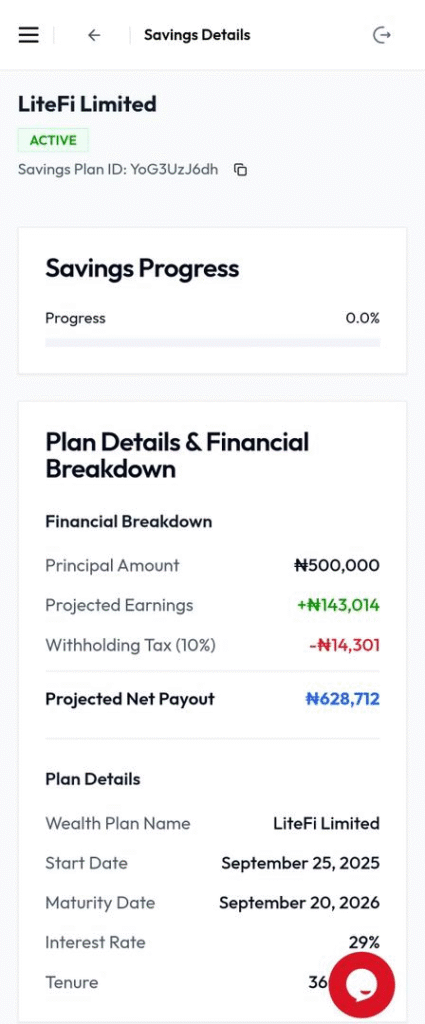

Investments You Can Read at a Glance

LiteFi curates money market instruments and commercial papers, presenting terms, tenor, issuer, risk band, and returns in plain language. Retail investors see exactly what they are buying and receive investment certificates for every purchase.

“On our platform, you see the issuer, the tenor, the risk rank, and the expected return. You get an investment certificate you can hold.”

By the Numbers

- ₦7 billion disbursed since early 2024

- 1,000+ customers served

- Portfolio risk under 1%

- Investments are typically approved within hours after compliance checks

How It Works Under the Hood

LiteFi’s bespoke underwriting engine combines traditional and alternative data. Its web app integrates with third-party verification tools for KYC, identity checks, and fraud screening. Product updates are pushed weekly to remove friction and improve the user experience. Investment orders are verified manually until LiteFi’s own license is approved, ensuring compliance with KYC and AML regulations.

“Everything is seamless on the front end, yet we still run compliance checks and human review where required. It is fast, but it is not careless.”

What Makes LiteFi Different

Going Where Others Do Not

Most lenders concentrate on Lagos, Abuja, and Port Harcourt. LiteFi is extending financing to peri-urban and underserved regions. This hybrid approach, digital onboarding plus local verification, means access for businesses that would otherwise be excluded.

Blending Digital and Human Touch

Some customers self-serve completely online. Others prefer guided applications. LiteFi supports both, structuring financing around cash flow realities rather than one-size-fits-all templates.

“Aside from adverse credit history, there should be a way to say yes. The structure may differ, but we work to find a responsible approval path.”

Trust, Safety, and Regulation

LiteFi operates under an existing consumer credit license and partners with licensed fund managers for its investment offerings. A full finance license is in progress to enable nationwide coverage. All customer data is processed under Nigeria’s data protection framework, and sensitive details are never requested via social channels.

“Compliance is why investment orders are not fully automatic yet. We would rather clear KYC and AML first, then execute within hours.”

Impact and Inclusion

LiteFi ties its mission to three UN Sustainable Development Goals:

- SDG 1: No Poverty – Affordable credit for families and micro-businesses.

- SDG 8: Decent Work and Economic Growth – Enabling retail investors to fund productive sectors.

- SDG 10: Reduced Inequalities – Extending credit beyond Nigeria’s financial hubs.

Customer Snapshot: A market trader without a registered business received ₦20 million after profiling and field checks, allowing her to restock inventory and grow her business.

Roadmap and What to Watch

LiteFi’s focus for the next phase:

- Deepening its lending and investment offerings

- Rolling out asset financing for equipment and clean energy solutions

- Exploring agricultural financing and a merchant toolkit to extend credit at the point of sale

- Securing a finance license to move from partner-based execution to full in-house capability

“Think of it as a practical financial toolbox. Borrow responsibly when you need to. Invest clearly when you can.”

Editor’s Note

Kayode Alao co-leads LiteFi with his partner. His career spans microfinance, grassroots credit, and fintech. His approach remains consistent: use data and judgment to unlock fair financing for those the system underestimates.